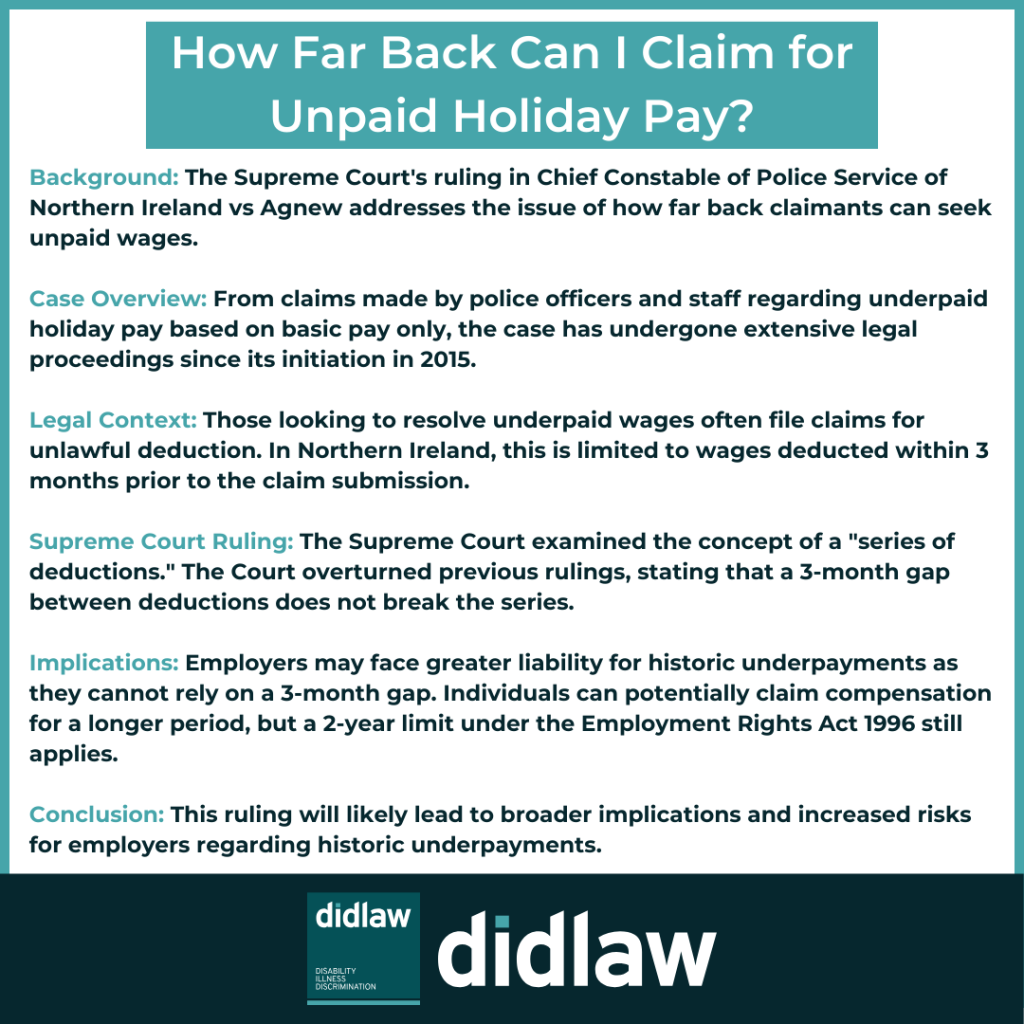

The Supreme Court has issued judgment in the important case of Chief Constable of Police Service of Northern Ireland v Agnew. The claim was first presented to the Northern Ireland Industrial Tribunal in 2015 and has travelled through the appellate Courts.

The case concerns how far back claimants can claim for underpaid wages and more specifically, unpaid holiday pay. This has been an issue that has seen more than its fair share of cases before courts at various levels over the years.

The claims were brought by police officers and staff working in the police, who asserted that they had been underpaid as their holiday pay was based on basic pay only. The claimants in the claim believed that the holiday pay should instead have been calculated to include periods of compulsory overtime.

Where an employee feels they have not received the full sum of wages they are entitled to, they can try to recover this unpaid sum by submitting an Employment Tribunal claim for unlawful deduction of wages. The relevant Northern Irish legislation, which is equivalent to the Employment Act 1996, states that a claim for unlawful deduction of wages can only be made in respect of a payment made in the three months prior to the claim being submitted. Where the unlawful deduction was part of a series of deductions, the deductions can be linked together and claimed for, as long as the last in the series of deductions falls within the three months prior to the claim being submitted.

The issue that the Supreme Court was required to consider was what constitutes a series of deductions. In Bear Scotland v Fulton the Employment Appeal Tribunal had concluded that repeated deductions could not be linked into a series if there was a gap of more than three months between each deduction. Accordingly, a gap of more than three months between two deductions would essentially amount to a ‘break’ in the series, and claimants would not be able to claim for deductions occurring before that break.

In the Northern Irish case, the Supreme Court disagreed with the Employment Appeal Tribunal’s ruling in Bear Scotland v Fulton. The Supreme Court concluded that although a claim must be brought within three months from the date of the last deduction in the series, this does not mean that a three month gap within the series of deductions amounts to a break in the series. This is big news for claimants and for employers.

The Supreme Court held that whether deductions form part of a series is a question of fact, and all relevant circumstances must be considered when making the assessment of whether repeated deductions are linked. This includes the similarities and differences between the deductions, the frequency, the size of the deductions and how they came to be made and applied. Whether or not the deductions were more or less than three months apart is not relevant when assessing whether the deductions are linked and form a series of deductions.

This Supreme Court ruling will mean that employers are at risk of being made to pay much larger sums to compensate for historic underpayments, as they cannot rely on the argument that a gap of more than three months between two payments breaks the series. This means that claimants can potentially go back much further when claiming compensation for historic underpayments. However, under the Employment Rights Act 1996 there is a limit of two years for how far back claimants can claim underpayment of wages for.

An important development in the law and one which will likely cause many ripples.

This blog was written by Yavnik Ganguly, a solicitor at didlaw.